The Shifting Landscape of Venture Capital

The current growth at all costs mindset has to change.

I recently met an entrepreneur with a decorated background in starting, scaling, and investing in startups throughout Silicon Valley and beyond. Like many others, he recently choose to leave the coast and relocate to one of the many growing tier two entrepreneurial ecosystems.

But with a no less ambitious project in mind - helping founders "go from zero to one in 3 hours"! Ambitious indeed! Gone are the days of months long product development, testing, and QA.

Today you can have a product in the market before lunch.

That conversation alone caught my attention, but it was a catch-up with one of the most experienced, multi-time founders in the 11 Tribes Ventures portfolio that really attuned my focus to this topic of growth mindset.

Our discussion centered around the things he would change in the early days of launching a company. His answer was intriguing...

Go to market earlier and more often with a low-code solution

Solicit direct customer feedback sooner and iterate faster

Take less money early (read: maximize ownership)

Both of these interactions helped codify in my mind a real time shift that is happening in the world of startups.

It's been called a lot of different things over the last few months. Kyle Harrison called it the Institutionalized Belief in the Greater Fool, a great venture builder named Jeremy Burton called them Mountain Goats, and a new friend of mine, Neil Thanedar, calls them Mittlestands.

We could make an argument for all sorts of different animals and names, but there is one common thread connecting all of them. There is a clear and tangible shift from a growth at all costs mindset to a durable, sustainable, and profitable growth model.

Entrepreneurs are choosing to build enduring companies.

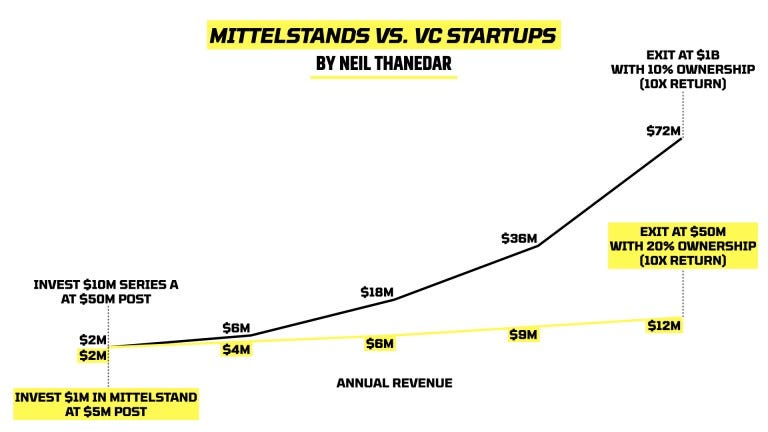

And why shouldn't there be? This is an opportunity for both entrepreneurs and investors alike to benefit from a different type of growth. Neil at Utopic Ventures gave permission to use this terrific chart he built. Take a look...

This is an excellent template for what I believe is the next generation of technology companies (Mittlestands or Enduring Companies). The top line is the world we have lived in for the past decade. Heavy capital infusion, 2-3X revenue growth every year, and huge multiples at exit.

Juxtaposed against a dramatically more sustainable, reasonable growth path and an exit that creates life changing business outcomes for its founder.

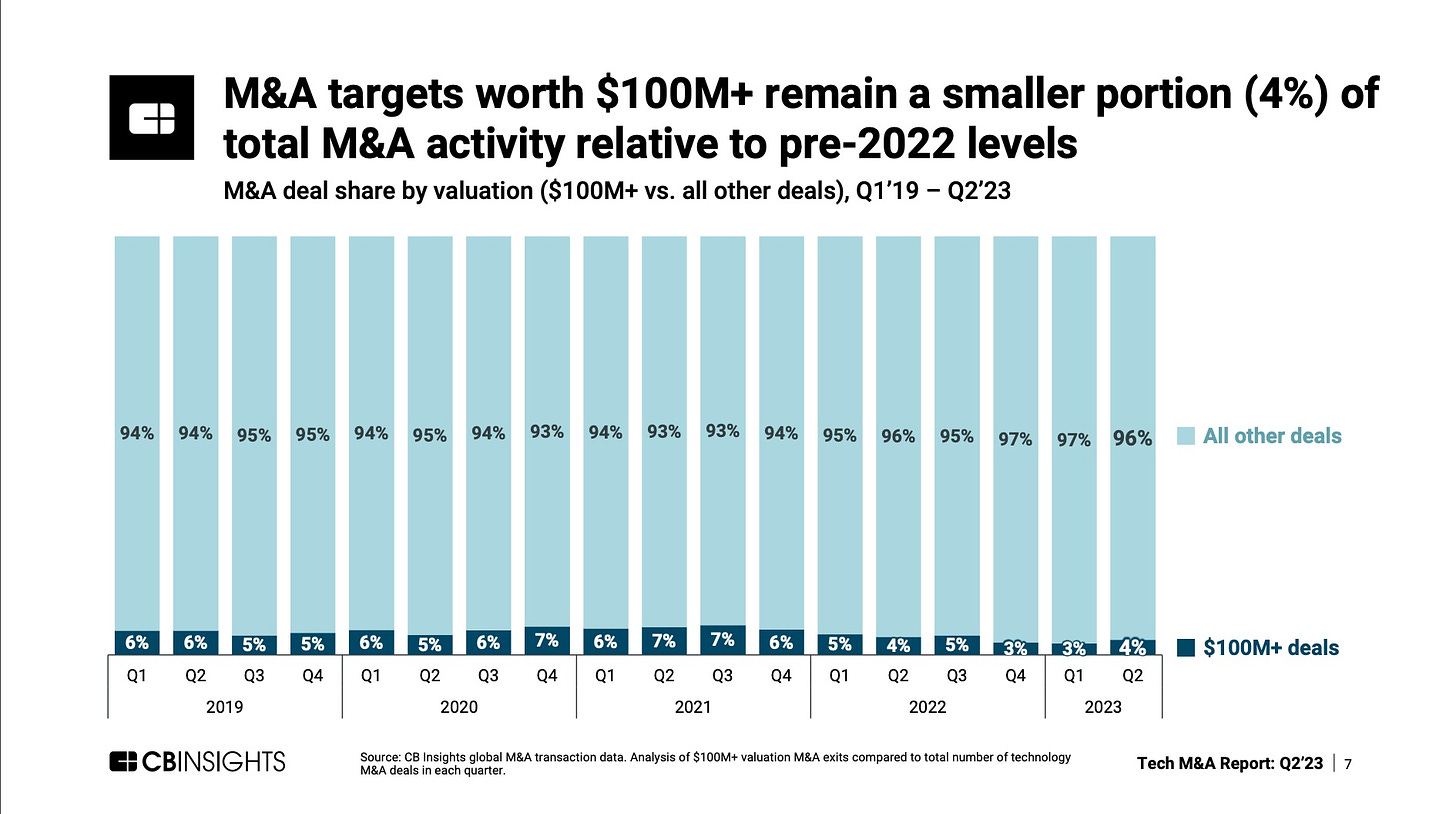

One other piece of data to consider. How many buyers are there for a $1B outcome? Not a lot. But <$100M? You’ll have a lot more opportunity to exit.

Kyle Harrison in his article on the "institutionalized fool" says it perfectly,

I think businesses whose operating model and valuation mechanisms were crafted between 2009 and 2021 all have a fundamental flaw of believing that the institutionalized belief in the greater fool will allow the next investor (the bag holder) to hide a multitude of sins. I'm a fervent believer in the need for technological progress and rapid change.

And I believe that venture capital is an overwhelmingly net positive force in the innovation necessary to drive that progress and change. But venture capital, as a discipline, runs an existential risk of invalidating itself by becoming institutionally what crypto is colloquially.

You may read this and think it is a temporary shift in the market - I've often heard the common refrain of "investors are now focused on profitability". But in my estimation, this is a much larger mindset shift. It will take time, but the common sense benefits of this shift are too strong to deny.

To wrap up, let me summarize where we've been and where I believe we're headed.

Where we've been:

From 2010-2020 we experienced one of the greatest bull markets in American history. This was driven by the Feds quantitive easing strategy and lead to an interest environment that made capital effectively free. This even impacted the world of early stage startups leading to blitz-scaling, massive funding rounds, and untenable burn rates.

This money drunk party, where founders were told to grow as quick as possible with little to no consideration of unit economics or profitability (read: making money), climaxed in 2021 when the government was quite literally giving everyone free money (but it's never really free). The institutionalized belief in the greater fool lead to late stage valuations that were out of whack with public comps leading to (according to Pitchbook) ~45% drop in late stage startup valuations since 2021.

But lets not forget about the people caught in the middle of this reckless behavior - the founders. Data on founder mental health, depression, anxiety, and burnout points to a distinct increase over the last decade. Maybe setting unrealistic goals with limited timelines and even more scarce resources is a bad idea?

Where we're headed:

Founders have a choice. What type of business do they want to build? And at what pace? Look at Neil’s chart above one more time. There are $50M businesses out there that can generate the same type of cash-on-cash returns as a hyper-growth startups.

Capital is no longer free. This means venture capitalists have to compete with a risk-free, completely liquid investment vehicle presently returning ~5%. We have to be better.A few areas of opportunity: more discipline when it comes to valuations, clarity for founders around timing and prioritization of profitability, and perhaps most important of all - a care for the founder. What happens to the leader and the team (the founder outcome as we call it) is just as important as what valuation they achieve at exit. Which leads to…

Investors aligning their capital with their values across their portfolio. This applies to both LPs and GPs. Technological progress and innovation will not stop, but as the market evolves, perhaps the financial returns are viewed through a broader lens that takes into account the opportunities the investment provides to its founders, the holistic wellbeing that the investment provides to it’s employees, and the opportunity for flourishing that the investment can create within countless stakeholder communities.

There is so much more to unpack when it comes to this mindset shift, but I for one am encouraged by the signs pointing to this next generation of entrepreneurship.

Let’s make sure that the institutionalized belief in the greater fool which allows the next investor (the bag holder) to hide a multitude of sins does not become the trademark of venture investing.

Let’s make sure we are investing into companies that truly create value.

Let’s invest in enduring companies.